Fund Investments:

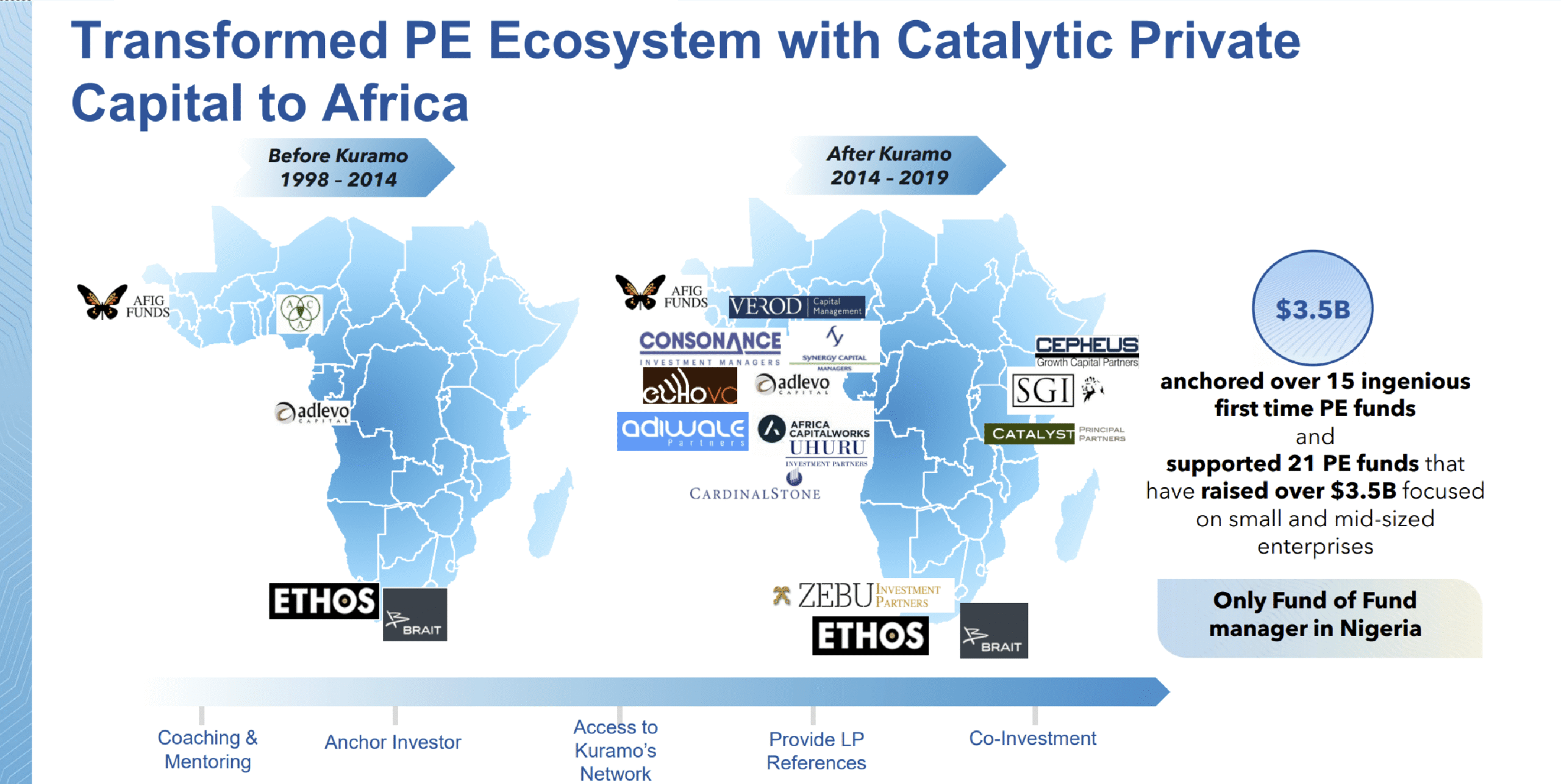

Pioneering the Acceleration of Catalytic Capital to Indigenous Private Equity Funds

Reinforcing our role as a pioneer and ecosystem builder. Through strategic and developmental investments, Kuramo has become a cornerstone of Africa’s growing financial infrastructure, channeling catalytic private capital to accelerate sustainable economic growth across the continent.

Adenia Capital III is a private equity fund supporting mid-sized companies in the Indian Ocean and West Africa. With a focus on strategic growth and operational improvements, Adenia fosters sustainable development by transforming promising businesses into regional leaders.

Adiwale Fund I focuses on SME investments in West Africa, targeting high-growth sectors such as manufacturing and consumer goods. By providing capital and strategic guidance, the fund accelerates business expansion and economic diversification in the region.

A long-term investor in Africa’s growth. With $172M in commitments, ACW backs mid-market businesses across sub-Saharan Africa through a permanent capital vehicle. The fund takes a sector-agnostic approach (excluding non-ESG compliant industries), offering patient capital and deep expertise to scale sustainable enterprises.

Capital Alliance Private Equity IV (CAPE IV) is a $570 million fund focused on the healthcare, energy, power, infrastructure, agriculture, agribusiness, telecomms, media, technology, FMCG, and financial services sectors in West Africa.

It focuses primarily on Nigeria, but also in neighboring countries such as Ghana, Cote d’Ivoire, Gabon, and Cameroon.

CAPE III was launched in May 2009 with the goal to make equity investments in high growth companies operating in West Africa including the Gulf of Guinea with a main focus on Nigeria. The fund’s target is to invest up to 40% of its commitments in the energy sector with the rest to be allocated to other promising sectors. The Fund will make equity and equity-related investments in companies with strong management and above-average potential for revenue growth and job

creation.

CardinalStone Capital Advisors Growth Fund 1 (CCAGF 1) is the Fund managed by CardinalStone Capital Advisors. The Fund is focused on SME and growth opportunities in West Africa. The Fund was launched in 2018 and has made 6 investments to date with $64 million in total commitments. Kuramo’s LP commitment accounts for 2% of the fund’s total commitments.

Cepheus Growth Capital Partners fuels Ethiopia’s economic growth by investing in manufacturing, agro-processing, and services. Through long-term capital and hands-on support, the fund helps businesses scale operations, improve governance, and adopt sustainable practices.

Backing bold, early-stage innovation. CKSOF fuels Africa’s next generation of consumer-focused and community-driven businesses. With 91% of the fund’s $20.2M commitments coming from Kuramo, the partnership reflects deep alignment in supporting transformative ventures across the continent.

EchoVC is a technology-focused early-stage VC firm investing in underrepresented founders and underserved markets. With a presence in Africa, the US, and the UK, EchoVC backs bold, tech-driven solutions across diverse sectors. Committed to unlocking potential, they empower visionary entrepreneurs to drive innovation, scale businesses, and create lasting impact.

Helios Investors II is a private equity fund that invests in high-growth companies across Africa. With a focus on financial services, telecoms, healthcare, and infrastructure, Helios supports businesses that drive economic development and technological advancement.

Medu Capital Fund III is a private equity fund with a multi-sector mid-market strategy in South Africa. The fund has a target fund size of USD 300m and will make investments of USD 7-47m in medium-sized businesses with an enterprise value between USD 13-130m.

Uhuru Growth Fund targets businesses in West Africa that create jobs, expand access to essential goods and services, and strengthen the healthcare and fintech sectors. By supporting post-pandemic recovery, the fund plays a crucial role in regional economic

Verod Capital Growth II, a Nigerian fund, provides growth capital to medium-sized businesses. The fund will seek to invest in attractive growth opportunities in companies, primarily in Nigeria, across multiple sectors (consumer products, services, manufacturing, agribusiness, financial services and energy).

Driving impact from farm to fork. AFSF is a $98M private equity fund investing in Africa’s agri value chain—boosting food production and processing at the SME level. With a focus on food security and economic inclusion, the fund supports scalable solutions to feed and empower the continent.